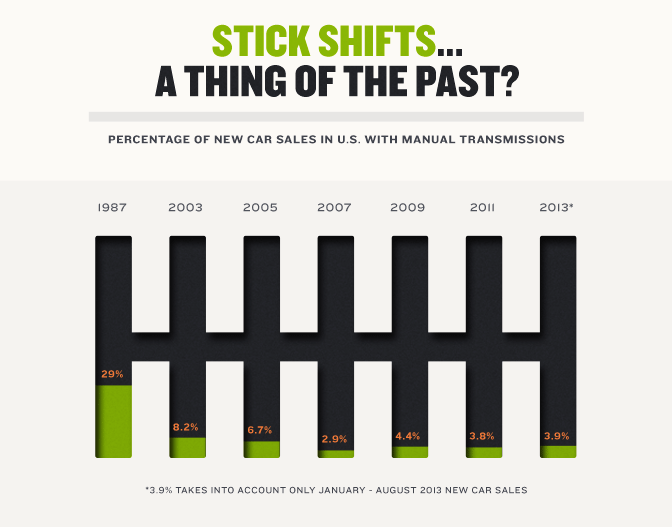

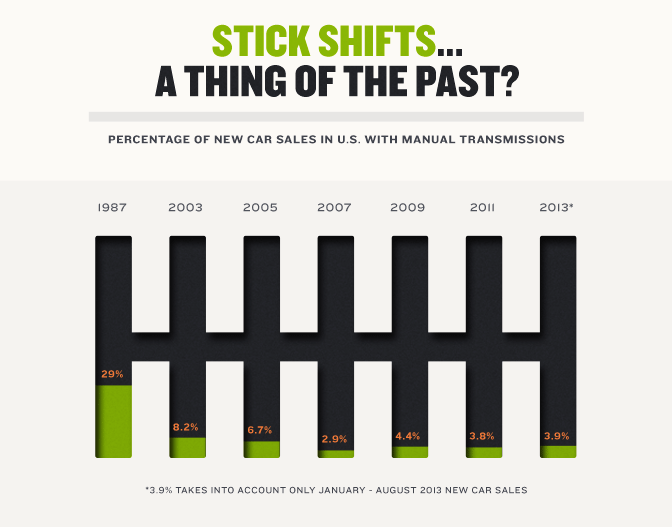

It is not a surprise that automatic transmissions are gaining huge...

5 Major Reasons Why Automatic Transmissions Are Popular In Amercia

It is not a surprise that automatic transmissions are gaining huge...

No matter what kind of style a woman carries, when it comes to gold...

Who doesn’t enjoys arranging a party at their home and getting to...

If meals can affect our fitness and form of our body it may...

Having to watch televisions and videos online makes us get quite bored. Watching the same old tv serials isn’t quite fun. If this is the case with...

Blurred photograph hs can demolish any picture. At the point when there is an issue with the clearness of a photograph, you can’t see...